US frets over pharma supply chain security

The pandemic highlighted how fragile the global manufacturing network is, as supply of certain products was limited and regulatory inspections became difficult to carry out. Ben Hargreaves finds out how the issue of foreign manufacturing has become a major US political talking point and how this could influence the pressures facing the industry.

In a global economy, across a number of industries, low-margin products are often manufactured in countries where labour is cheap. The pharmaceutical industry is no different, with India and China becoming two of the leading manufacturers and exporters of generic medicine, as well as medical supplies, antibiotics and ingredients required to manufacture treatments.

According to research, the US is reliant on overseas production for two-thirds of its demand for generic medicine and 90% of generic active pharmaceutical ingredient (API) facilities are not located within the US. This puts the US in a position where it is almost entirely dependent on other countries for access to certain treatments. In particular, China is the second largest exporter of drugs and biologics to the US and the largest for medical devices. In recent years, this has become a major talking point within US politics.

Security of supply

The reason the US government is worried about the supply of pharmaceuticals is immediately clear, a problem securing access to antibiotics, for example, would be a major public health issue. According to data from a report by the American Action Forum, the US is not overly dependent on one country for its broader supply of antibiotics, with Canada, India, Italy and China supplying the bulk of demand. However, for individual antibiotics, China is the main source of the ingredients for penicillin and cephalosporin, which represent approximately two-thirds of the antibiotics used in the US each day.

This is enough to cause concern within the US government, leading it to recently pass a bill through the Senate with aims to boost the US manufacturing sector and to diversify the supply chain, specifically in regard to a perceived overdependence on China. The government’s stance reflects a wider mood within the US population, as a poll conducted by Americans for Safe Drugs suggested that 85% of respondents deemed US government policies to encourage domestic production of generic products as being ‘somewhat’ or ‘very important'.

The pandemic effect

The growing importance of the question over supply will likely grow, as the pandemic has raised fears over the supply of medicine. The worries over potential supply issues were not helped when, for a brief period during the early period of the pandemic, India restricted the export of certain APIs and drugs. As a major trading partner of India for pharmaceuticals – the US market represents the destination of 54% of India’s drug, pharmaceutical and fine-chemicals exports – this will have raised alarm bells for the US government.

However, one of the greater challenges during the early parts of the pandemic was one of access – with much of the world limited in terms of movement. The US FDA plays a key role in ensuring the quality of drugs that are being manufactured and brought into the country, a task that became fundamentally more difficult alongside the pandemic.

Last year, the FDA published a report detailing its efforts to carry out its work during the pandemic and its plans to address postponed inspectional work. By its own figures, the agency managed 61% of the planned inspections it had scheduled for 2020. As a result of the pandemic, the FDA has had to ‘roll over’ any missed inspections into the following year, meaning that its planned inspections grew from 21,000 in 2020 to 26,250 in 2021. As a means to navigate the pandemic environment, the FDA carried out in-person inspections for only facilities considered high-risk, while opting to rely on remote interactive evaluations for low- and moderate-risk facilities.

All of these factors have led to a reduction in foreign inspections, with the agency reporting that between April and September 2021, it had carried out 37 human drugs-related inspections. Though the work carried out by the agency could not be carried on as normal due to the pandemic, this did not stop the United States Government Accountability Office releasing a report calling for improvements to its foreign inspection program.

With a greater political emphasis on improving domestic manufacturing of treatments, the industry itself is being pushed, in turn, by the FDA to strengthen its own supply chain. In a release last month, the agency called on companies to mitigate or prevent drug shortages due to “drug quality problems, vulnerabilities in the global supply chain, unanticipated increases in demand, market withdrawals of drugs, or natural disasters.” As part of its recommendation, the agency called on companies to develop, maintain, and implement risk management plans for their supply chains.

How industry is reacting

For the industry’s part, PhRMA published a report last year where it suggested that it would improve supply chain capacity and highlighted the importance of investing in pandemic preparedness and planning. The industry had been helped in this goal through the huge amount of funding that went into boosting capacity for vaccines and for vaccines supplies through Operation Warp Speed, with a significant portion of this investment seeing facility expansions in the US.

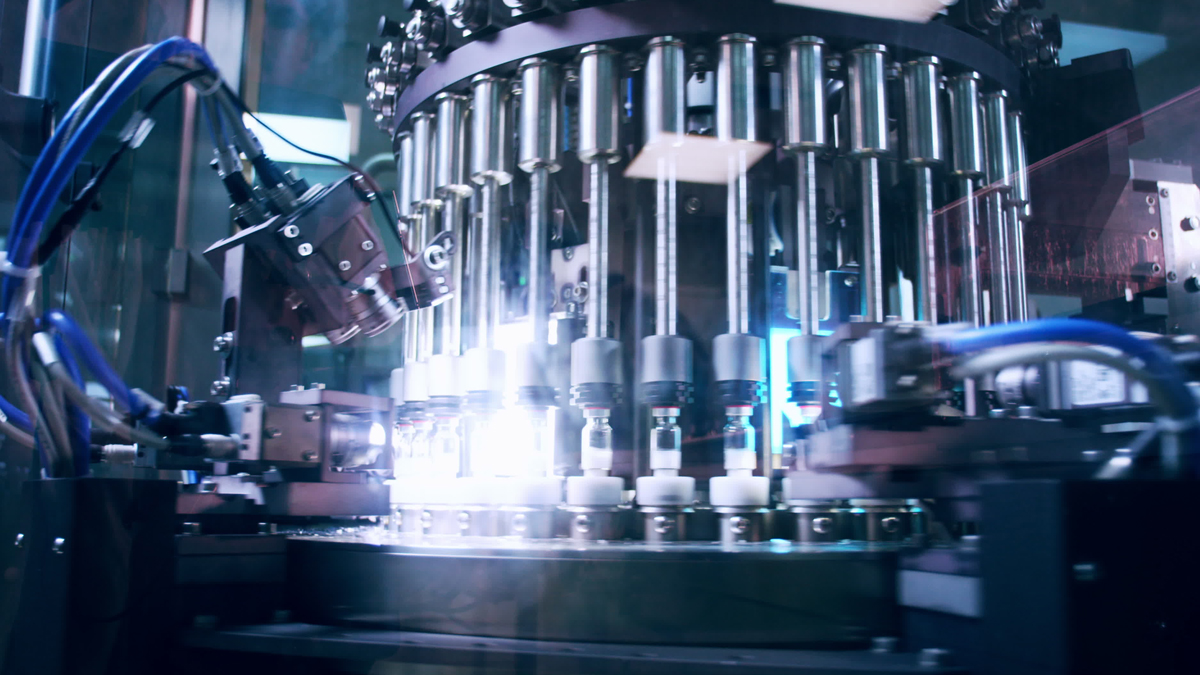

Broader than just products related to the pandemic, there have also been strategic investments made to cater to the political demand for greater domestic manufacturing in other areas. Jackson Healthcare announced last year that it would reopen a US manufacturing facility for the production of antibiotics, after acquiring the site and operating the business through its subsidiary, USAntibiotics. The company stated that it would become the only US company able to manufacture amoxicillin and would be able to meet the country’s entire demand for the antibiotic once the facility was operational.

"As the first doses of USAntibiotics' life-saving drugs move down the assembly line, America will have declared its independence from Chinese antibiotics," said Rick Jackson, founder, CEO, and chairman of Jackson Healthcare, at the same time as the facility reopening was announced. A spokesperson for USAntibiotics declined to provide further details on the company’s plans and the wider supply chain issues in the US.

There is clearly a growing appetite across the industry to call attention to expanding manufacturing presence within the US. Only last month, Eli Lilly unveiled a $2.1 billion investment for two US manufacturing facilities in Indiana and underlined the company’s history in the area. While manufacturing projects for proprietary products will remain feasible in the US, where the necessary infrastructure and talent is a significant aid, it remains to be seen whether the industry will make similar moves in low profit areas, such as in genetics and antibiotics. However, while the direction of travel in politics is clearly moving towards greater domestic manufacturing, the industry can expect greater calls for this to happen.