ViiV gets FDA nod for Rukobia drug for older HIV patients

The FDA has approved Rukobia, a first-in-class drug from ViiV Healthcare intended for older people with HIV, who have been on antiretroviral therapy (ART) for so long it is starting to fail.

When the HIV epidemic started more than 30 years ago, patients could only expect to live for one to two years from diagnosis but the introduction of increasingly effective combination ART regimens has since restored the life expectancy of people with HIV to near normal levels.

The trouble is, there is an increasing population of people with HIV who have been on ART for so long that it is starting to lose its efficacy. In fact, more than a third (36%) of the US HIV-positive population – some 400,000 people – were aged over 55 in 2018.

HIV specialist ViiV – which is majority-owned by GlaxoSmithKline – has claimed approval from the US regulator for Rukobia (fostemsavir) as a rescue therapy for heavily pre-treated adults in whom the virus has developed resistance to multiple ARTs.

The clearance is based on the phase 3 BRIGHTE study, which showed that fostemsavir was significantly better than placebo when added on to current therapy at reducing viral load in this hard-to-treat patient population.

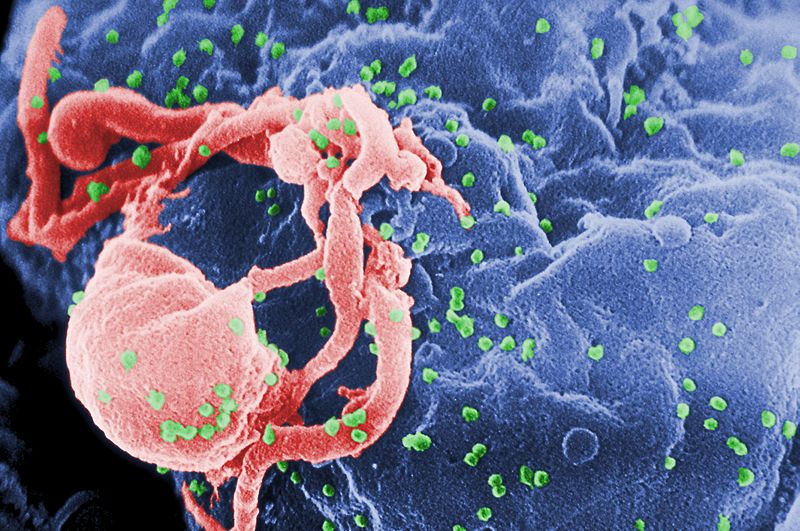

Rukobia is the lead drug in a new class of HIV attachment inhibitors, which bind to a glycoprotein (gp120) on the envelope of HIV and prevent the virus binding to host cells. Its mechanism of action means there is no cross-resistance to other classes of anti-retroviral drugs, according to ViiV.

The drugmaker estimates that around 6% of all adults with HIV in the US have been heavily pre-treated and so are at greater risk of progressing to AIDS.

That’s a relatively small but growing group of patients, and analysts have predicted that sales of Rukobia will be modest at around $400 million, much smaller than ViiV’s other new products – like Juluca (dolutegravir/rilpivirine) and Dovato (dolutegravir/lamivudine) – which some analysts think could garner $1 billion-plus revenues.

Nevertheless, it's another addition to ViiV’s product range as it tries to wrest market share from Gilead Sciences, its arch-rival in the HIV market.

Gilead has been growing at a phenomenal rate thanks to new drugs like triple therapy Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide). Meanwhile, ViiV has been trying to convince doctors that its two-drug regimens are safer and more cost-effective, although at the moment Gilead seems to be in the ascendency.

Sales of Biktarvy more than doubled in the first quarter of this year to $1.7 billion, while during the same period Juluca grew 71% to $150 million and Dovato added another $82 million.

ViiV suffered a setback in its HIV franchise at the end of 2019 however when the FDA rejected its once-monthly injectable Cabenuva (cabotegravir/rilpivirine), after finding fault with manufacturing data for the drug. Fostemsavir has also been submitted for approval in other markets, including Europe.