Strategy and evaluations part one: governance & staffing

Jean?Louis Roux Dit Buisson

Foro Ventures

In part one of three, Jean-Louis Roux Dit Buisson starts his series by sharing his thoughts on the spin-off benefits of evaluation processes on governance for strategic management &, staffing within pharmaceutical and healthcare companies.

,

“Intellect has a keen eye for method and technique, and is blind to aim and value.”

A. Einstein

Imagine Facebook had relied on something practical, easy to understand and to follow to assess its price. Imagine this tool guiding you towards meaningful decisions fitting with all, including non-financial, dimensions of your strategy.

A number of management tools have been developed in order to facilitate decision making and bring some rationality in what could seem to be otherwise a gut feeling / experience based process.

,

"The purpose of this article series is to revisit, with the eye of the practitioner, the key benefits of project / company valuations..."

,

However, the number of disappointments that mergers and acquisitions (M&,A), venture and the biopharma industries report year-in year-out incites us to think that if such tool exists, it is misused or simply misunderstood.

The purpose of this article series is to revisit, with the eye of the practitioner, the key aspects of project / company valuations, and to propose practical solutions for the implementation and strategic use of advanced evaluation methodologies.

Part one will be dealing with governance and staffing aspects and the more operational how-to-like aspects will be dealt with in upcoming articles.

1. The fallacy of net present value (NPV) &, internal rate of return (IRR) as decision making tools

As an illustration we shall use the following proposal to introduce a new compound in the development pipeline. The executive in charge, from the M&,A and / or business development and licensing (BD&,L) department, has provided the board with the following results:

Figure 1: diagram to show NPV and IRR

Everyone in the board room is happy as a “decision” seems obvious to all. However, decisions reduced to their simplest expression, i.e. a number, are short from being decisions, it’s more like the dictatorship of results.

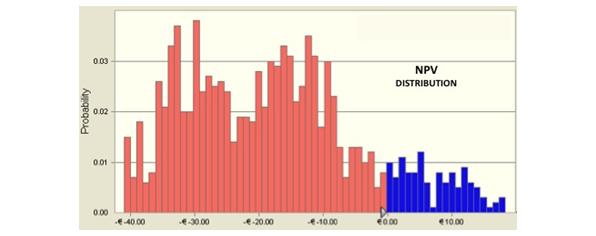

Effectively, as one starts looking at the dimensions of targeted sales and investments (€ 75 million / year, 25% of sales respectively) compared to the current NPV, one could start feeling uneasy: NPV could easily turn out negative (figure 2) depending on the volatility in key assumptions. So why in most cases would executives limit their governance to approving a number? Why wouldn’t they ask for more strategic background in the decision making?

Figure 2: NPV distribution (the graph was obtained by using Crystal Ball, a Monte Carlo simulation program on the project assumptions).

An explanation might be that the financial tools used to sustain some models are complex to understand, another, that decision making is painful and relying on a number quite comfortable. A third explanation, especially in industries with long product life-cycles, is that the purpose of evaluating a project, a portfolio or a company, is to come up with a go / no-go decision until the next milestone is reached, and possibly the burden of calling a stop is an option left to successors?

2. Evaluations brings strategic insight to the forefront of decision making

Evaluation is more than a financial model. It is a tool allowing strategic “what if” questions:

• What if the market changes?

• What if the expected profile is different?

• What if new regulations impact prices?

In addition, evaluation ought to be considered as a strategic process that has a life of its own in parallel to the life of your project.

Both these attributes (process and tool) make the experience of evaluations essential for the governance of a company, generating unique insights for the management of the future action plans:

• Identifying which are the key value drivers.

• Identifying which set of hypotheses have been used for these drivers.

• Deciding whether or not these assumptions make sense at the point in time when the decision has to be made.

It’s at this time that I throw W Buffet’s quotes at my incredulous students: “Risk comes from not knowing what you are doing”, and “Only invest in business you understand”.

3. Sensitivity analysis

The next question is how to identify the few variables that deserve management’s full attention.

,

"...directors might have to rely on their networks and on external consultants on an ad-hoc basis, which generates a loss of knowledge over time..."

,

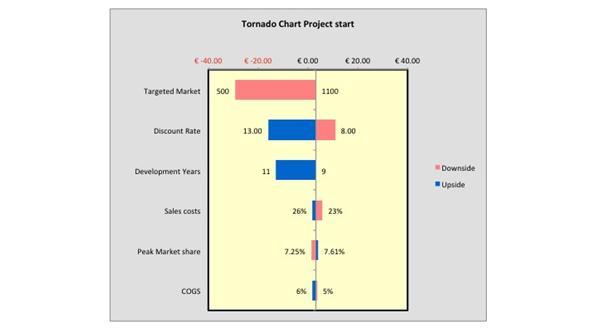

Modern simulation Excel add-ons offer applications that will compute these for you as tables and / or dramatic graphical representation: sensitivity analysis, tornado diagrams, and scatter diagrams.

Figure 3: Tornado chart project start

Results for our example are shown on the tornado analysis above, which also shows that managers have selected the most favorable hypothesis to present to the board as a base case.

As amazing is the influence of operationally determined parameters, which usually generate heated debates, there is little impact on the strategic value of the project, as sales costs, targeted market share and the cost of goods sold (COGS) are all maintained within politically correct and generally accepted ranges.

We would argue that strategic information, embedded in charts and tables, related to assumptions and sensitivities is of highest relevance for the deciding board and that its value for the governance of the company is incomparable to the value of single metrics like NPV and IRR.

4. Results and consequences

While some of the directors’ room issues have been discussed above, also take into consideration the boardroom material below:

• Key value drivers for early stage projects are out of the direct control and influence of operational managers: markets evolutions, competitive moves till time of launch, what the compound has to reveal on its attributes, etc...

• The discount rate is as expected an essential component of value. Some would argue the discount rate only influences the calculation of value. We believe that the discount rate, through its primarily associated to the management and past history of the company, is highly influenced by the governance and the management of the company.

• Key value drivers do not evolve in their preeminence as time passes by.

In the coming paragraphs we review the consequences of the above observations.

Insights and staffing: As key value drivers are outside the reach of operational managers, how can relevant information be acquired, processed and submitted to the board?

Larger structures can operate with strategic staffs, though this creates additional problems of its own, essentially of cultural and political nature, which can have disastrous consequences as we’ll see below. In smaller structures, directors might have to rely on their networks and on external consultants on an ad-hoc basis, which generates a loss of knowledge over time, and eventually an imbalance in information.

Markets and targeted market share: Who should provide the information concerning the most sensitive parameters such as market size, competition, product profile and the like? Operational managers might have a bias towards NIH syndrome, professional planning staff might have to rely on the wisdom of external consultants. The issue is essential as we have all heard about companies paying 10 times sales, just to write-off 90% of the acquisition premium within a couple of years.

,

"A board focusing on understanding key drivers, their impact and strategic alternatives will have increased chances of success..."

,

Product profile: The second most important factor in determining the potential sales level is the competitive product profile. Based on existing knowledge will it be a blockbuster?

A few mathematical theories from the finance industry have been used to model the potential evolution of sales. They have created more confusion than generated additional thinking value, and have been accused to overinflate results. This is based on a lack of understanding and a lack of carefully explained implementation.

Discount rate: A board focusing on understanding key drivers, their impact and strategic alternatives will have increased chances of success and will benefit from a lower overall risk premium and an appreciation of share price.

5. Summary

Throughout part one, we have shown that the key value adding step in evaluation of projects and companies, has to do with the process of evaluation, most particularly with the sensitivity analysis concerning key drivers.

We have seen that boards can spend plenty of time and energy on issues that have little influence on the value created, and that most value drivers are influenced essentially by externalities. And we have also seen that incorporating product profiles and amended discount rates are essential drivers of value, and will be the subject of upcoming articles.

View part 2 of this article here.

About the author:

Jean-Louis Roux Dit Buisson is a Professor of Entrepreneurship at the Grenoble Management School in France. He is founder of Foro Ventures, a company dedicated to provide assistance and interim management for top-line growth projects and turn-arounds.

Jean-Louis is specialized in high technology sectors (such as Bio Pharma, Medtech). He has an MSc from MIT and an MBA from INSEAD and can be reached at jl@forotech.ch.

How can pharma companies improve their governance and staffing?