Real world evidence for pricing and reimbursement: the potential of Systemic Anti-Cancer Therapy (SACT) data

The difference between how a drug works in trials and how it works in a real world setting can be large. Now that NHS Trusts in England are providing SACT data, can this information provide some answers about medicines' effectiveness and true value?

Knowing which medicines work, which don't, and in which patients, is a key interest for everyone; from the patients and their families, to clinicians and, of course, to the payers who want to be assured that the sometimes expensive price tags for the latest cancer medicines are worth it.

The tricky thing has been moving from the evidence of efficacy (how well a medicine works in the trial setting) to effectiveness (how well a medicine works in real life, which can differ substantially from the trial setting). In England, the maturing of the Systemic Anti-Cancer Therapy (SACT) dataset could help provide some answers.

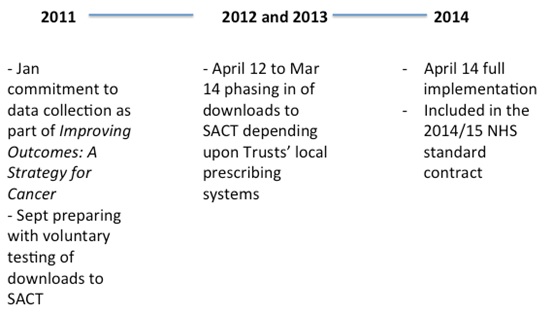

The commitment to SACT began in 2011, followed by phased implementation across the Trusts up to full reporting by April 2014.

The data held in SACT

The dataset, as long as hospitals provide the data, should cover all systematic anti-cancer therapy, whether it's delivered by the private sector on behalf of the NHS, and to both the young and old for the whole of England. So far, that's data on over 150,000 patients.

There are 43 data items, which cover demographics and provider, clinical status, programme and regimen, cycle, drug details and outcome, with the date of death added from the Office of National Statistics. (The full detail for all data items is available in the user guide on the SACT website).

The purpose of SACT

The SACT website says that the purpose of SACT is to 'support patients and their clinical teams in choosing appropriate care based on accurate knowledge of current practice and the corresponding benefits and toxicities of treatment'. This is a bold ambition, and one that needs to go beyond mere reporting of the data and provide appropriate context to help its usefulness when a clinician faces an individual patient's idiosyncrasies.

Plus SACT will also enable identification of variation; in fact those hospitals where there is 'marked variation from expected practice' will be subject to clinical review. So SACT could also, over time, subtly encourage prescribers to move towards the 'average'.

SACT - a brief history

As mentioned earlier, SACT has been around since 2011 (see figure), but it has taken time to set up, not least because hospitals collate the data on chemotherapy using different methods. Some Trusts were much further along with electronic prescribing than others, for example.

In theory, the data should be pretty good; it's underpinned by the prospect of close scrutiny from NHS England (they pay the chemotherapy bill of over £1 billion a year at the moment) and supply of data to SACT is mandated through the NHS standard contract. Although formal sanctions haven't been set out, few managers are likely to relish a difficult conversation with NHS England about failing to supply the data.

SACT today

Although it is still a relatively immature dataset, much analysis has already been carried out using the data now held centrally, as set out in various reports. Some of it is more about progress with the dataset itself, such as the data completeness report or the SHAPE report (this allows hospitals to check that the activity reported to SACT is in line with what they thought it would be).

Other reports are starting to shed light on just what the NHS does in chemotherapy; the regimen benchmarking report illustrates the regimens most often used across different types of cancer and how it varies by hospital, and the top 10 regimens by diagnostic group report does just what it says.

SACT data has also been used to look at variations in body surface area of patients, actual doses received (which can be compared to those used in trial settings) and, in conjunction with the Association of the British Pharmaceutical Industry (ABPI), to explore whether there is ageism in NHS treatment of cancer. Sadly, it seems there could be.

SACT in the future

England's National Clinical Director for Cancer, Sean Duffy, also sees scope for SACT to explore not just variation between hospitals, but also how each compares to NICE guidance on what is the best option for a given cancer and group of patients.

"With the controversy surrounding the value of the fund itself, knowing what it buys in terms of health outcomes could be very useful"

Coming in the future could be what the outcomes are from those drugs paid for by the Cancer Drugs Fund (CDF) since these, too, are in the scope of SACT. That fund is for those products that NICE considers to be too expensive for the benefit they bring, or are still being assessed by NICE, or will never be looked at by NICE. With the controversy surrounding the value of the fund itself, knowing what it buys in terms of health outcomes could be very useful. This is still not published and is prompting some to ask why.

And there's no reason, in theory at least, why SACT can't be linked up with other data or expanded so that it can delve more deeply into outcomes for patients that can go beyond survival (as important as that is, it is clearly not the whole story).

SACT and pricing and reimbursement

Talking to the Chemotherapy Intelligence Unit (CIU), which holds the data and analyses it, it's clear that there has been much discussion, including with pharmaceutical companies, of the potential to draw on SACT as part of novel pricing and reimbursement approaches. This could see provisional use of, and perhaps provisional prices for, new medicines in oncology linked to how well patients do.

Of course, the principle is simple; if the medicine delivers, the NHS should pay in line with the value of what it delivers (and I'm ignoring the complexities of determining that value – a whole other ball game!). But, as ever, it's complicated in practice:

• How long to wait until there is enough data (both in terms of number of patients but also in how long to wait before final health outcomes are available) to confidently draw any conclusions?

• Do you include all patients, even if they weren't, for example, prescribed the medicine within the indication that is licensed?

• Who can see the data, and analyse it? How is appropriate confidentiality maintained?

• Can price go up if the benefits are far greater than anticipated, or down if they are far less? Does that price change feature as a confidential NHS price or a public list price?

Perhaps all these complexities explain why we've yet to see a company willing to use SACT data in this way. But maybe there are brave companies out there which will in 2015. Roche, in particular, sees potential; it has set up a joint initiative with the NHS to look at streamlining the processes used to submit to SACT and explore how to use the data. Roche even says that SACT can support Patient Access Schemes (these schemes tend to offer confidential discounts to the NHS, but can also link price to health outcomes) as well as multi-indication pricing.

This project began in June 2014 and is due to last a year, so we may not have too long to wait to test out the real potential of SACT in pricing and reimbursement.

About the author:

Leela Barham is an independent health economist and policy expert who has worked with all stakeholders across the health care system, both in the UK and internationally. Leela works on a variety of issues: from the health and wellbeing of NHS staff to pricing and reimbursement of medicines and policies such as the Cancer Drugs Fund and Patient Access Schemes. Find out more here and you can contact Leela on leels@btinternet.com

Have your say: What influence can real world data really have?

Read more from Leela Barham: