Small-to-medium pharma fear a ‘good’ Brexit won’t be achieved

A survey of small-to-medium pharma companies in the UK has revealed seven out of ten have “little or no confidence” in the government’s handling of Brexit negotiations, and nearly two-thirds believe a ‘good’ deal won’t be achieved for the sector.

The findings come from the first ‘Brexit barometer’ survey by the Ethical Medicines Industry Group (EMIG), a membership organisation for SME pharma companies.

The survey was conducted in February, and clearly shows that most of the 70 respondents from the smaller pharma companies are worried about the long-term impact of leaving the EU.

There were two further key findings from the survey:

59% think not delivering a ‘good’ deal will result in higher prices for medicines and medical devices;

81% think not delivering a ‘good’ deal will result in delayed access to medicines and medical devices.

The poll was held before the UK and the EU announced on 19 March that they had agreed a two-year transition deal, keeping the UK within EU rules until December 2020.

The news was welcomed by many in business, including GlaxoSmithKline’s (GSK) chief executive Emma Walmsley. However the biggest questions – including how medicines will be approved and regulated in the UK after Brexit – still hang in the balance.

This uncertainty should end in October this year, which the EU has designated as the deadline for all Brexit negotiations to be concluded. Nevertheless, many observers predict that the complexity of post-Brexit trade and regulation negotiations mean they could drag on past this date.

EMIG chairman Leslie Galloway says the Brussels mantra of “nothing is agreed until everything is agreed” very much applies to the Brexit negotiations – the kind of uncertainty which is anathema to business.

[caption id="attachment_15643" align="alignnone" width="161"] Leslie Galloway[/caption]

Leslie Galloway[/caption]

Commenting on the survey findings, he said: “All those results reflected how I felt as well,” but he says he expects a more optimistic mood in the next Brexit barometer, thanks to the transition deal being agreed.

EMIG will run the survey once a quarter to track the views of its members on the Brexit negotiations, and has pledged to use the results to engage with the government and parliamentarians to ensure SME pharma’s voice is heard in the next phase of the negotiations.

Asked if Brexit had the potential to hit small-to-medium pharma companies more than big pharma, Galloway agreed.

“The big boys can afford to pull out all the stops to make sure they’re prepared for Brexit. Smaller companies will hedge their bets and take a risk.”

GSK recently revealed it expects to spend £70 million on Brexit planning and transition over a three-year period.

Galloway says he “worries for those that might get caught out if it all goes wrong”, such as the UK crashing out of the EU with no deal, but adds that he would take the same sorts of calculated risks if he were in the same position.

Brexit is forcing companies to weigh up the risks: on one hand, they can spend time and money on preparing for all possible scenarios; on the other, they can gamble that a deal will be struck, thereby allowing them to spend less on contingency planning.

The survey made it clear that many respondents are busy making preparations. One respondent said their company was preparing for the worst case scenario, and anticipated import/export delays, the need to duplicate batch testing and release, and transfer of EMA marketing authorisation out of the UK to another EU member state.

This last point will apply to all UK-registered EMA licences, as it will become a ‘third country’ after Brexit, unless a special “associate membership” deal can be struck.

Another respondent said their company had set up offices in Switzerland and Germany to mitigate the effects of Brexit, while a third was obtaining a Manufacturers Import Authorisation (MIA) document in expectation that this would be required for all EU-UK trade.

Just over half of the respondents to the survey represented companies with 50 or fewer employees, with another quarter from firms with 50-250 employees.

Fortunately, the majority (69%) of respondents said their costs to date for preparing for Brexit were currently under £50,000, at the lower end of the scale set out in the survey.

Nevertheless, this is a major cost for smaller companies, and Galloway says it adds to other internal market pressures making the UK less attractive to pharma.

He says that, in addition to Brexit, the UK now has the most complex market access system in Europe, with the Budget Impact Test and NHS England’s specialised commissioning budget the most notable extra hurdles.

“All of this is not making the UK look like a good place to do business,” he concluded.

Even with a Norway or Canada model, Brexit means more friction

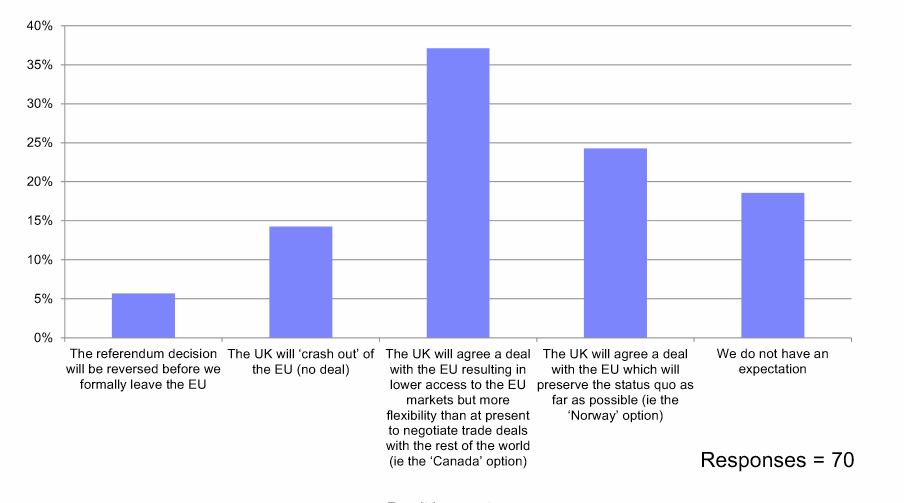

On the question of the most likely outcome from the talks, respondents were split.

38% said they expected the UK would secure a deal resulting in lower access to the EU markets but with flexibility to negotiate trade deals – the so-called Canada option. Just under a quarter said a ‘Norway’ style deal was most likely, which would allow much of the current regulatory and trade status quo to be preserved.

A Norway-style deal is very much what the UK industry organisation the ABPI is hoping for, but this currently looks unlikely based on Prime Minister Theresa May’s insistence that the country will leave the single market and the customs union.

A further 18% said they had “no expectation” of the outcome, while 14% believed the UK would crash out with no deal, and just 6% thought the referendum decision would be reversed.

What is your company's current expectation of the UK's future trading arrangements with the EU?

Source: EMIG Brexit Barometer, April 2018.

Commenting on these results, Leslie Galloway believes a deal will be struck.

“I don’t think it’s in the European Commission’s interests to have a Hard Brexit,” says Galloway.

“It would be really silly to not be as aligned as possible; there is a lot of wisdom in alignment,” he added, including areas such as pharmacovigilance and patient safety.

Decrying arguments being put forward by hardline pro-Brexit groups that the UK could thrive with a ‘clean’ Brexit, he said this ‘misinformation’ was getting in the way of a sensible debate about future relations.

Nevertheless he added: “On the basis of the transition deal, I am cautiously optimistic that they’ll reach a deal in October.”

Just as important for the UK are decisions taken by the government and NHS England on market access. The most notable of these is the replacement for the current PPRS pricing deal, which must be renewed or replaced by the end of 2018.

Talks between industry representatives and the government are set to begin very soon, and Galloway says he hopes to include in the agreement a New Medicines Fund for England as part of a renewed agreement. He says if the idea is agreed and executed correctly, it could be a major boost for the UK market, and help to offset the worst effects of Brexit.