Three pillars of post-pandemic launch excellence

IQVIA's Sarah Rickwood reviews the launch of innovative medicines in 2020 and outlines three key pillars of activity for companies to focus on and address in 2021

It is undeniable that 2020 was a particularly challenging year to launch non-COVID innovative prescription medicines. The launch environment was directly impacted by the COVID-19 pandemic, which hit two key drivers of launch uptake particularly hard: the dynamic market, i.e. new and switch prescriptions, and face-to-face interactive engagement with healthcare professionals.

Even with the vaccine roll-out, further waves of COVID infection and continued lockdowns mean these vital drivers of launch performance remain impacted in 2021, and even beyond. Longer term challenges, such as the slowdown of HTA outputs, delays to clinical trials and regulatory submission, and the coming impact of economic crisis on medicines budgets will further challenge launch prognosis in the coming years. It is therefore critical that companies are armed with a clear understanding of these evolving dynamics and start acting now to adapt their launch plans, focusing on three key pillars of activity to address post pandemic Launch Excellence.

The first step is to evaluate what happened to innovative launch in 2020. IQVIA’s ongoing Launch Excellence research programme focuses on understanding the evolving story of the pandemic’s impact on innovative launch. To do this, it is important to clearly define what is meant by launch and launch performance. Here we assess the launches of New Active Substances (NAS) only. These are innovative prescription medicine molecules (small molecules and biologics) that are entering a given country market for the first time. We measured the pandemic impact on the launch of NAS at four levels.

- Approval by regulators such as the FDA or EMA, as reported by the regulators themselves

- Availability in a commercial distribution channel, as measured by appearance in IQVIA audit data

- Access or approval granted by a Health Technology Assessor- as measured by IQVIA’s HTA Accelerator audit of HTA decisions

- Achievement, meaning commercial performance in the context of sales uptake, as measured by the IQVIA sales audits

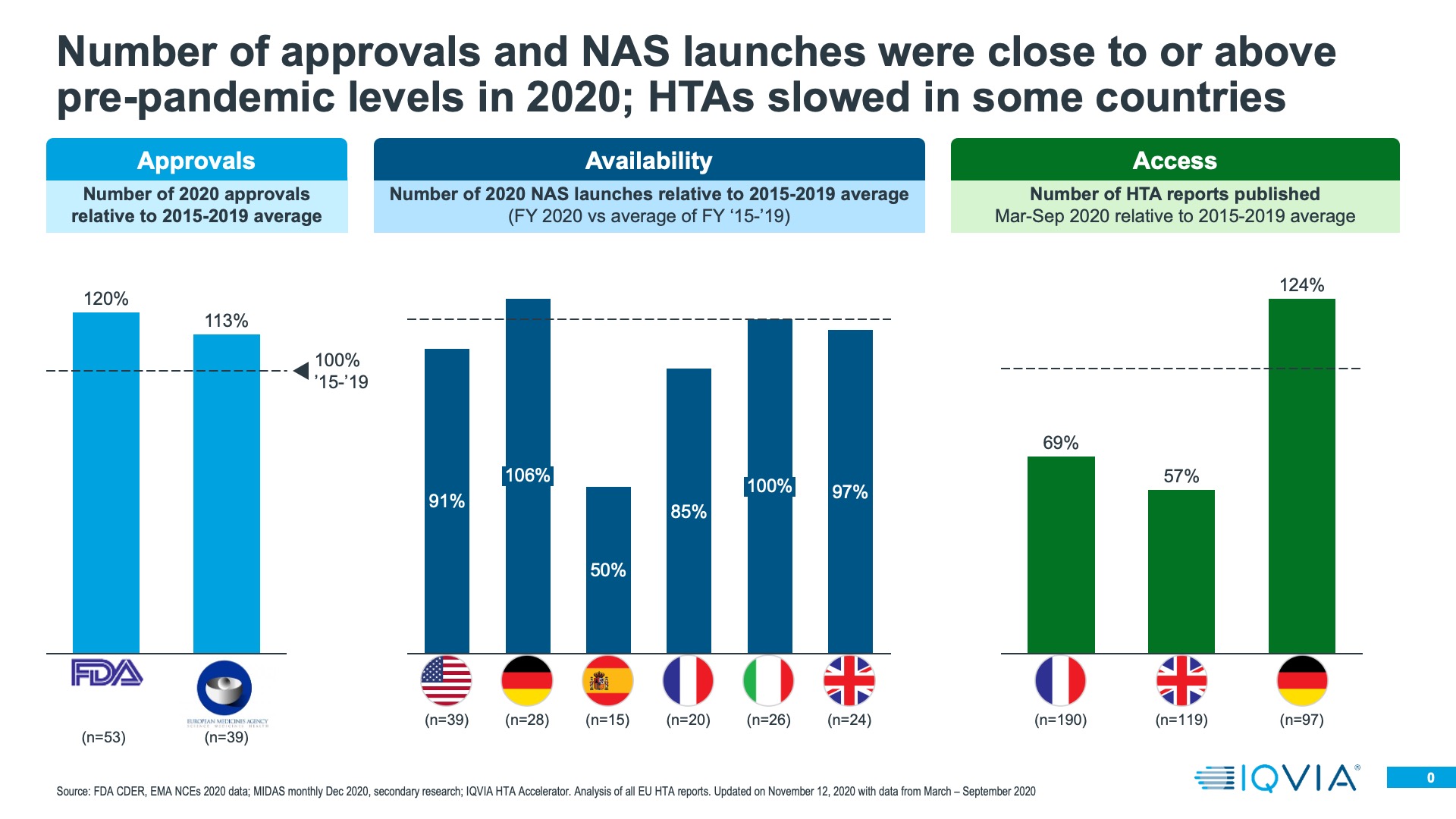

Both the FDA and the EMA rose to the pandemic regulatory challenge very well- addressing the specific COVID treatment and vaccination needs, as well as keeping standard medicines approvals going. Regulatory approval of innovative medicines does vary from year to year; it is dependent on what is moving through the research and development pipeline. Taking the longer term view of the last seven years, 2020 was a rather good year for innovative medicine approvals in both the US and Europe- an improvement on 2019, even with the extra approvals of COVID treatments and the first of the vaccines accounted for. This should perhaps be unsurprising; the medicines approved in 2020 would have been submitted pre-pandemic.

For regulatory approval, the key future launch question will be whether submissions in 2020 happened as expected, or were delayed because of the pandemic. The longer term impact of 2020 on clinical trial activity, given widely documented pauses on trials, will only be evaluable in coming years.

Once approved, launches do not necessarily become immediately commercially available. During the pandemic, it would have been reasonable for companies to delay commercial launch to re-evaluate launch plans- in the US, BMS did do this for Zeposia, a multiple sclerosis treatment, but in general there was little evidence of mass delay of commercial launch even at the start of the pandemic. There remains a difference between a launch being approved and commercially available, and IQVIA can use its MIDAS sales audits to evaluate the latter. We compared the cumulative number of New Active Substances entering each of the EU4+UK for the first time in 2020 with the average of the same measure in previous years – from 2015-2019. With the exception of Spain and France, the number of New Active Substances entering the market was at or above historic levels in 2020.

Presence on the market after approval is just the second hurdle; for launches in European countries the next task is to gain a favourable level of market access. For most countries, a pre-requisite for this is the opinion of the country’s Health Technology Assessment (HTA) body- for example, IQWiG in Germany or NICE in the UK. We used HTA Accelerator, an IQVIA tool which tracks HTA decisions internationally to understand if 2020 saw changes in the rate at which HTA decisions were made, or the quality (positive versus negative) of those decisions. In the UK and France, HTA decision making did indeed slow down. Not so in Germany, where a resilient system meant that productivity in terms of HTA decisions was higher in 2020 than the historic average from 2015-2019. Where there have been reductions in overall decision making output, there has also been prioritisation – decisions on cancer treatments have been made at historic levels, whereas for non-cancer treatments, decision output fell.

There clearly has been a bottle neck to effective market access caused by the pandemic in 2020 in some countries. However, a longer term challenge would be if HTA decision making becomes more frequently negative, something that could be driven by a worsening economic situation and tightening healthcare budgets. So far, however, there is little evidence to suggest that HTA decisions are becoming markedly more negative than in previous years.

In the end, approval, availability of a product on the market and its market access are all gateways to the main measure of 2020’s impact on launches- how the product performed in sales terms. Evaluating 2020’s impact on this measure is by no means a completed story; launches in December of 2020 may still have only a few months’ sales to evaluate; those launched in January are now over a year old and should be well established on their launch course. However, preliminary perspective is possible – we have taken two approaches.

First, 2020’s launches can be compared, by country, to the launch cohorts of previous years. To do this, we need to compare like with like, and therefore selected the first six months of continuous sales on the market as the comparison period. This is a completed set for all previous years, but a work in progress for 2020, as a product launched in December 2020 will only have completed its first six months sales in May 2021. In addition, launch cohorts do perform differently – for example, the years 2015 and 2017 were especially strong in Italy, because those were the years when modern Hepatitis C treatments such as Harvoni became available, and high unmet need in Italy combined with healthcare system readiness to fund for a significant number of patients.

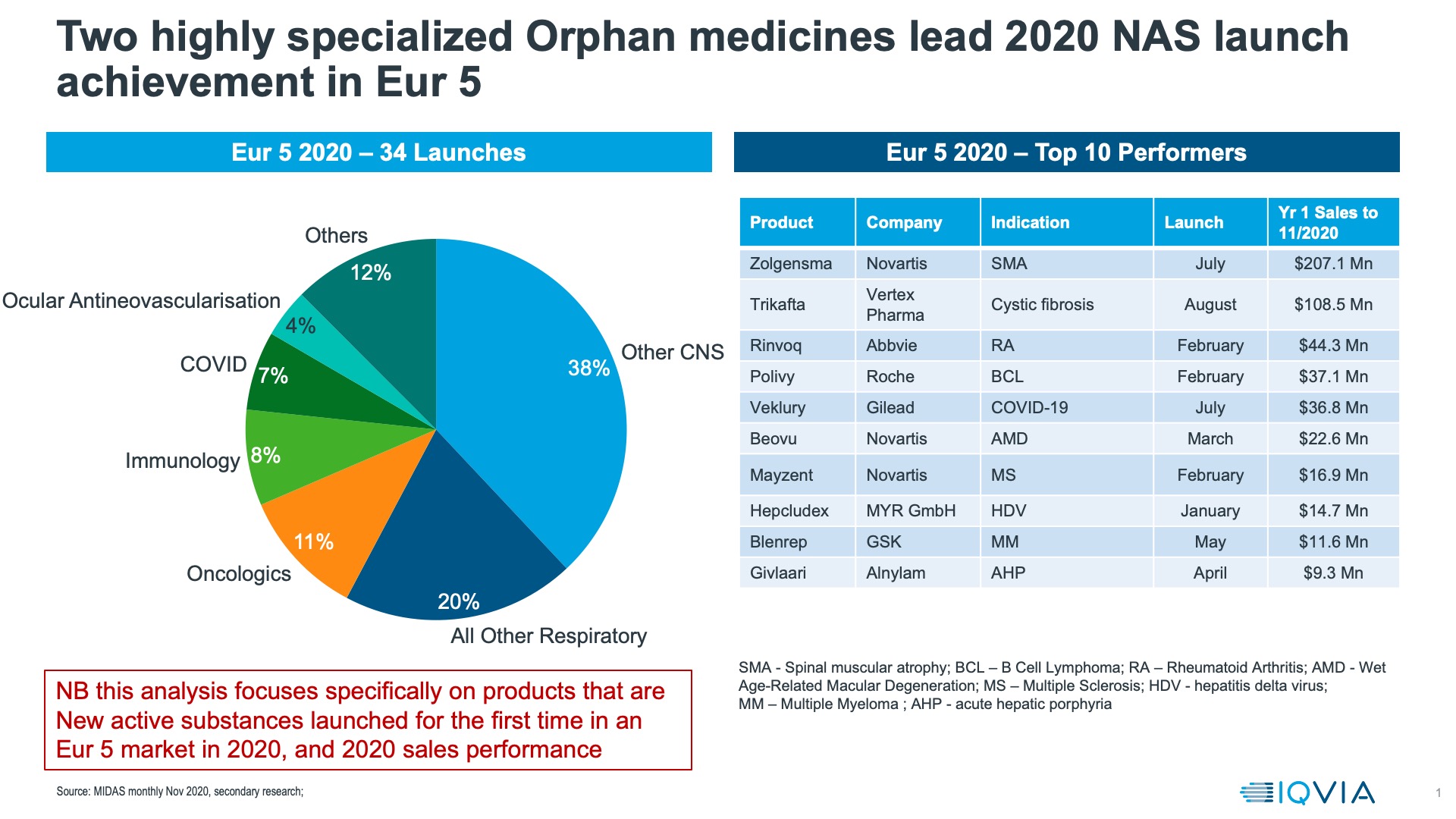

Using MIDAS sales data, we compared the performances of New Active Substances launched in Europe in 2020. Orphan Medicines, led by the gene therapy Zolgensma and the Cystic Fibrosis treatment Trikafta were the most successful launches according to IQVIA list price sales data in Europe in 2020 (figure 2).

We also assessed the first six months of sales for New Active Substance launches with and without Orphan medicines. We also excluded licensed COVID-19 treatments- of which, in the EU, there were only two in 2020, and only one, Veklury (remdesivir) which was a New Active Substance. Looking at the major European markets, EU4 + UK, we found that 2020 ranked among the lowest of the last 6 years for launch sales uptake in 3/5 of the leading European countries for all NAS launches, with or without orphan medicines. In no country is 2020 a strong year for the first six months NAS launch. It is important to note here that this is a preliminary assessment that will evolve as more data becomes available and more launches are fed into the model once they reach 6 months on the market.

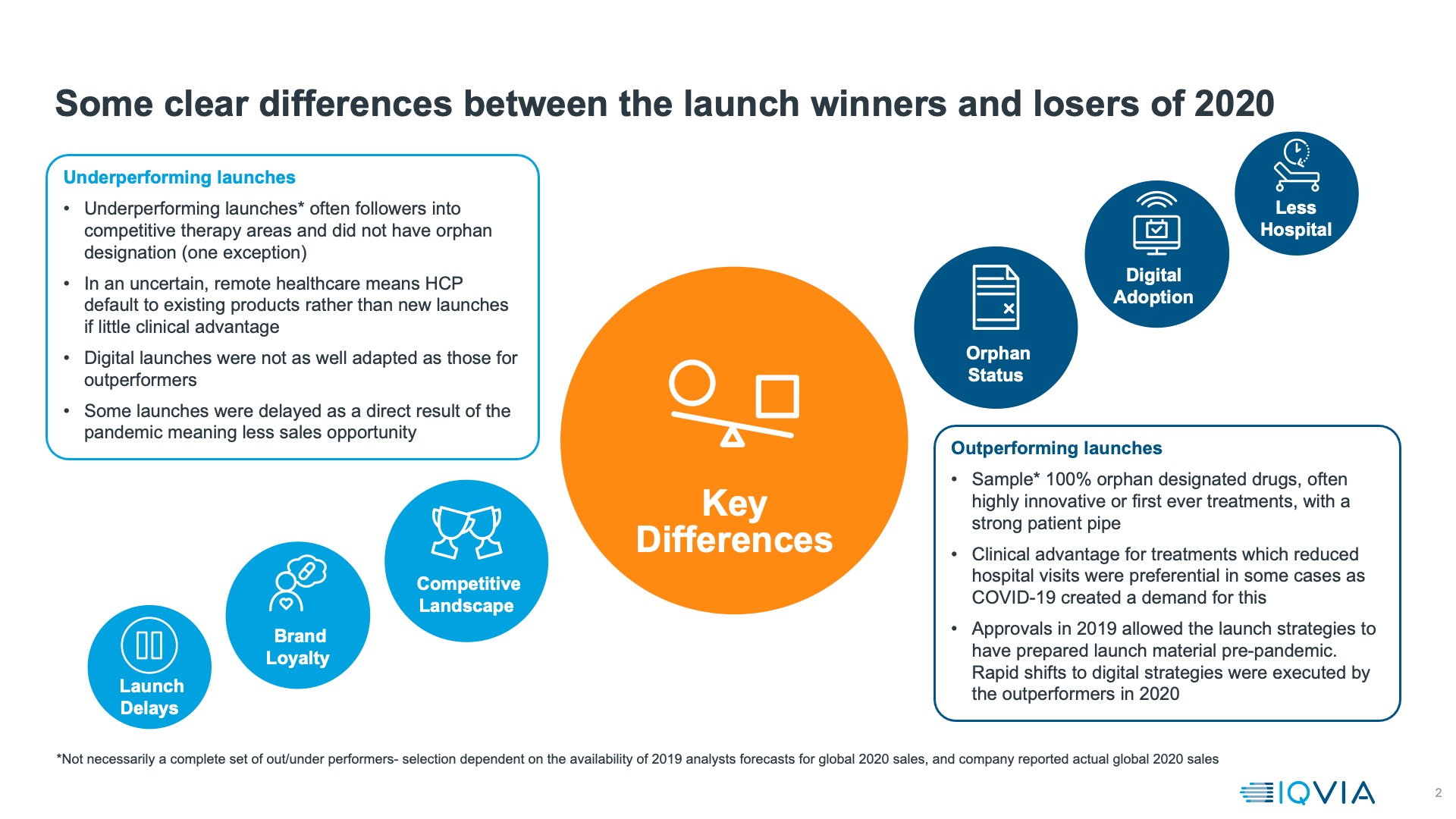

Another approach to evaluating how launches did in 2020 is to compare actual achievement with the forecasts made (by analysts) in 2019, before any knowledge of the pandemic. These are global, and may be incomplete as they rely on analysts having made those forecasts and companies publishing 2020 sales figures, but comparison of the launches that outperformed in 2020 versus analyst expectations and those that underperformed shows a stark contrast – all out-performers for which we have data are orphan medicines, whereas only one of the underperformers is.

Key global outperformers are mostly launched in the US alone; we therefore approach generalisations with caution, but the common threads for these launches (as shown in figure 3) is that:

- they are orphan medicines, often with an exceptionally strong clinical story. The best outperformer of all, Tepezza, is the first pharmacotherapeutic ever for Thyroid Eye Disease, a rare but debilitating condition. Trikafta (also known as Kaftrio) for Cystic Fibrosis represents state of the art treatment for 90% of cystic fibrosis sufferers.

- In some cases, they reduce the number of times patients must visit health facilities: Adakveo reduces the number of vaso-occlusive crises that sickle cell anaemia patient suffer – crises which typically land patients in an emergency room. Similarly, Reblozyl treats transfusion dependent anaemia in myelodysplasia, reducing and in some cases eliminating requirements for blood transfusion.

In addition to these characteristics other launches that did well despite the pandemic shared an element of luck- they were already approved in 2019 and had already undertaken most of their launch preparation by the time the pandemic hit. For orphan launches into areas of severe unmet need this meant that a pipeline of patients already existed who could still be moved into treatment despite the pandemic. For other launches it meant a vital few months before the full impact of lockdown hit, although it’s notable that the successful launches pivoted very rapidly to all virtual launch models.

Despite the fact that there have been some outstanding successes in 2020, the challenges for innovative launches which lack orphan status or a clear pandemic related advantage (eg in keeping patients out of hospitals or allowing them to self-administer) remain into 2021, and possibly beyond, when they will be joined by increasing economic challenge. To succeed in this environment, we have identified three critical pillars of post-pandemic launch success.

Understanding and addressing the changed patient journey to effective diagnosis and treatment

Effective launch needs doctors to be able to diagnose patients for the first time and make new prescriptions, or evaluate existing patients and switch prescriptions. For some conditions, face to face meeting is an essential prerequisite for these decisions. In others, it is very much preferred, and will continue to be considered best practice. Patient journeys to effective diagnosis and treatment have been severely disrupted by the pandemic. Telemedicine, remote treatment, altered treatment protocols and missed or sub-optimal treatments have all exacerbated existing challenges on the patient journey or raised new ones. The more complex the patient journey was before the pandemic, the more likely it is to be vulnerable to pandemic disruption. Patient journey challenges have led to patients dropping out, and a “treatment gap” or backlog to be addressed.

Getting as many patients as possible back to effective diagnosis and treatment is something on which the interests of patients, healthcare systems and pharmaceutical companies see alignment. For pharma, the first step is to understand the changed patient journey- how it is impacted, where the bottlenecks are, what impact this has for their product. Understanding how these could be addressed and the appropriate interventions of pharma then follows.

Re-designing commercial model strategy in a more hybrid customer engagement environment

Throughout 2021 and into 2022, we live with the obvious environmental challenges of a socially distanced, uncertain healthcare environment with significantly reduced opportunities for face to face meeting – whether it be between doctor and patient, or pharmaceutical representative and doctor. Face to face meetings between pharmaceutical reps and doctors have always been an extremely important element of launch introduction. The good news is that the early indicators are that in many major European markets and the US, live e-detailing is not only delivering meetings as long or longer than face to face ones, but ones that are equivalent or even better in terms of doctor intention to prescribe.

With a changed environment here for the longer term, launch strategy as well as tactics have to change. A swift pivot to digital helped tide companies over the immediate impact of lockdowns, but it must now evolve into a long term new commercial strategy, in which a much more hybrid, multichannel approach to launch is key. The good news for the commercial model is that already, pre-pandemic, the most commercially successful launches were also the most digital ones. During 2020, we have seen encouraging signs that remote e-detailing can not only deliver a detail that is longer in length than face to face details in many countries, but also one, that for most major countries, is as effective or more effective in terms of driving intention to prescribe. Reps, of course, remain central to the hybrid model, where a combination of face to face and remote engagement must be used to optimise on what are likely to be scarcer engagement opportunities. They will, however, need new skills to be able to engage effectively both in person and remotely, and be deployed in a commercial model which has the right data and platform to optimise all channel opportunities. Whilst reps will continue to be vital, the deployment of reps and other customer facing team members becomes a significantly more challenging choice in the uncertain and risky environment we will continue to see in 2021 and beyond. Rather than take on permanent employees, pharmaceutical companies may want to make more effective use of contract sales and other customer facing teams, to develop a more agile and locally relevant response, using a combination of appropriately skilled reps, Medical and Payer liaison, and nurse support teams. As healthcare systems recover, it is difficult to predict what will be needed, when. An approach which combines flexibility on resource to meet rapidly changing needs with capability – in terms of digital and remote skills, may be required.

Building a future fit value proposition backed by a Real World Evidence strategy delivering competitive differentiation

Lastly, investment now in an effective and competitive Real World Evidence strategy will yield impact when it is most likely to be needed – as the longer term economic consequences of the pandemic tighten belts on healthcare spending from 2022 onwards. Medicines budgets are unlikely to be able to grow much in times of economic challenge, and the cost relief anticipated from Loss of Exclusivity for the next five years is smaller than has historically been the case. It is also significantly biologic and biosimilars, although a mature market, do not yet yield cost savings as efficiently as small molecule generics do. Payers are likely to be in a position where they have to prioritise between spends on new launches, and prioritisation will be based on evidence. Launches with superior Real World Evidence demonstrating their differentiation and value will be in a more advantageous position. RWE studies take time to set up and run to yield evidence; for the right evidence dossier in 18 months, start investing now.

The launch environment has always evolved- today’s highly specialty product driven environment is a far cry from the primary care, share of voice driven world of the early 2000s. To stay ahead, companies with Excellent launches have always planned their launch strategy with the environment that they would be launching their product into firmly in mind. In this sense, the Pandemic has not changed the need to understand and anticipate changes in the launch environment, merely made them more complex and disruptive than before. Launches will still succeed, but success will be built on a robust strategic plan with the three pillars of post pandemic Launch Excellence at its heart.

About the author

Sarah Rickwood has 26 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has wide experience of international pharmaceutical industry issues, having worked for most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan and leading emerging markets, and is now vice president, European thought leadership at IQVIA, a team she has run for eight years.

Sarah Rickwood has 26 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has wide experience of international pharmaceutical industry issues, having worked for most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan and leading emerging markets, and is now vice president, European thought leadership at IQVIA, a team she has run for eight years.