Gilead Sciences' push into oncology is paying off, as Veklury falters

Gilead Sciences' investment in oncology has started to provide a solid return, with sales of cancer therapies breaching the $500 million threshold for the first time in the second quarter.

Cell therapies Yescarta (axicabtagene ciloleucel) and Tecartus (brexucabtagene autoleucel) for lymphoma and leukaemia together brought in $368 million, up 68%, while antibody drug conjugate Trodelvy (sacituzumab govitecan) rose 79% to $159 million thanks to increased uptake in triple-negative breast cancer.

The increases in Gilead's oncology franchise comes as growth slows in its main HIV therapy business, and as sales of COVID-19 therapy Veklury (remdesivir) fell sharply as the pandemic starts to abate.

Veklury drove sales growth at Gilead through 2021, but started to shrink in the first three months of the year and declined 46% to $448 million in the second quarter.

The fall reflects "COVID-19 related rates and severity of infections and hospitalisations, as well as the availability, uptake and effectiveness of vaccinations and alternative treatments for COVID-19," said the company.

Gilead is no stranger to managing 'boom and bust' products – think back to the spectacular rise and swift fall of its hepatitis C virus (HCV) therapies a few years ago – and the shift to a more diversified business under chief executive Daniel O'Day has softened the latest blow.

Trodelvy's swift increase from its approved uses in TNBC and bladder cancer comes ahead of plans to expand the use of the TROP2-targeting ADC into new uses like hormone receptor-positive, HER2-negative metastatic breast cancer – an indication which according to some analysts could add $900 million in annual sales.

The drug is central to Gilead's plan to make one-third of revenues from cancer drugs in 2030, so with results in the TROPiCS-02 study in June showing modest impact on progression-free survival in this form of cancer, all eyes are on an overall survival readout due later this year. Gilead acquired the drug as part of its $21 billion takeover of Immunomedics in 2020.

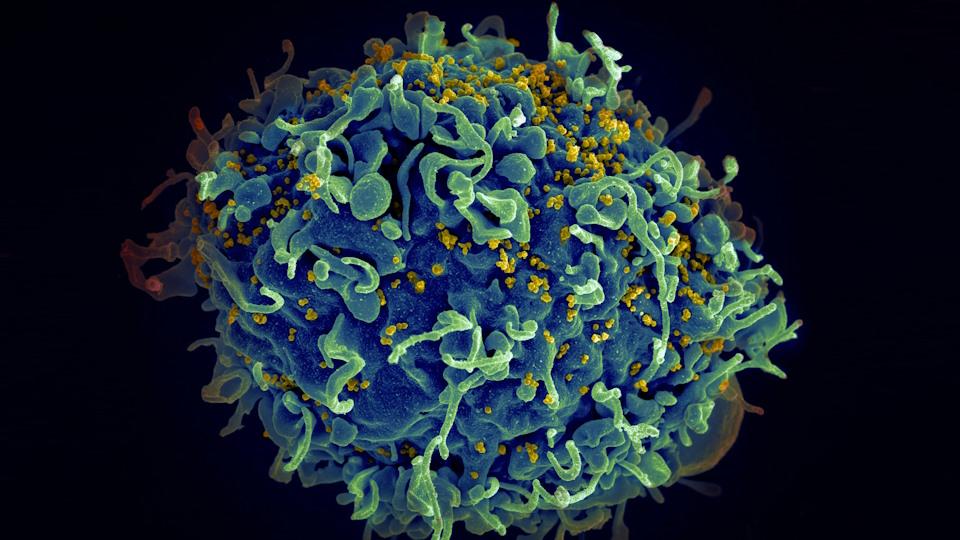

Gilead's HIV portfolio meanwhile brought in $4.2 billion in the three-month period, a rise of 7% that continued a recovery following declines during the pandemic.

Triple-drug regimen Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) rose 28% to $2.6 billion, offsetting declines for older therapies.

"This was a very strong quarter…with solid commercial and clinical execution," said O'Day. "There was continued strong demand for our HIV portfolio with further share growth for Biktarvy, and oncology revenues reached an all-time high, driven by cell therapy and Trodelvy."