A sea-change for pharma? Pandemic commercial models and launch

Sarah Rickwood looks at how COVID-19 is changing pharma’s commercial models and launch strategies.

The terrible pandemic crisis we’ve had as our daily companion for six months is far from over, in part because it is in fact not one crisis, but three.

There’s the initial pandemic crisis, which wreaked havoc on communities and stretched urgent care systems to the brink; the consequent healthcare system crisis, where the knock-on effects of the pandemic are still playing out in non-COVID patients and the wider healthcare system; and the economic crisis that is largely to come.

In this article, I reflect on how the three COVID crises are reshaping the way in which innovative pharmaceutical companies engage with all their customers, and in particular how they consider their commercial models and innovative launch strategies.

Challenges ahead

If the COVID pandemic has taught us one thing, it is that certainty is a commodity in short supply for some time to come. But that doesn’t mean we are completely flying blind. IQVIA has quantitatively tracked the impact of COVID on the way pharma engages with its customers using its ChannelDynamics audit of HCP/pharma engagement, specific primary research, as well as the IQVIA MIDAS and audits on Rx sales and patient visits and treatments.

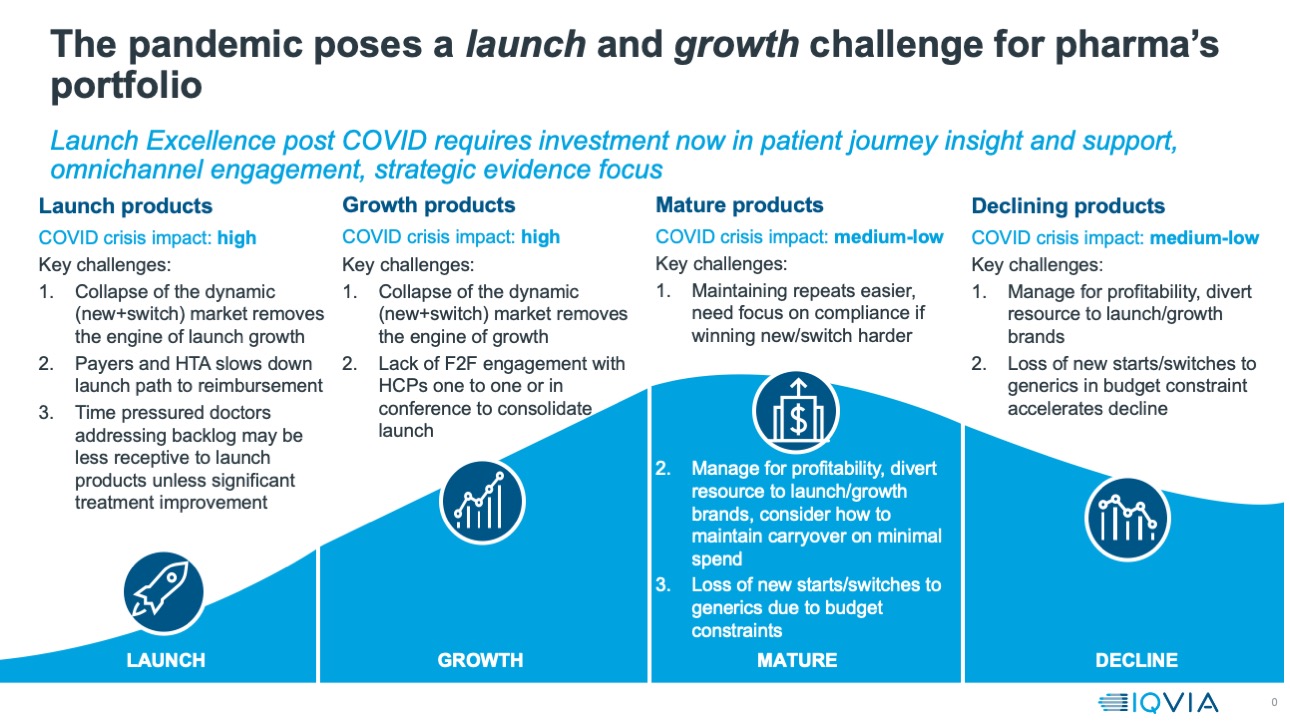

Armed with this evidence, a clear picture is emerging about the way in which commercial engagement for innovative prescription medicines is changing, and will continue to change, and what companies must do to survive and thrive in the post pandemic world. To do this, they must understand how the pandemic will continue to affect the prospects for the launch and growth products that are a company’s future.

As the graphic below shows, these products will be particularly affected by the impacts of the pandemic on patient journeys, the number of new and switch patients (the ‘dynamic market’) the regulatory, health technology and market access infrastructure of the pharmaceutical market, and the altered level and type of engagement between pharma and healthcare professionals.

The dynamic market, the patient journey and telemedicine

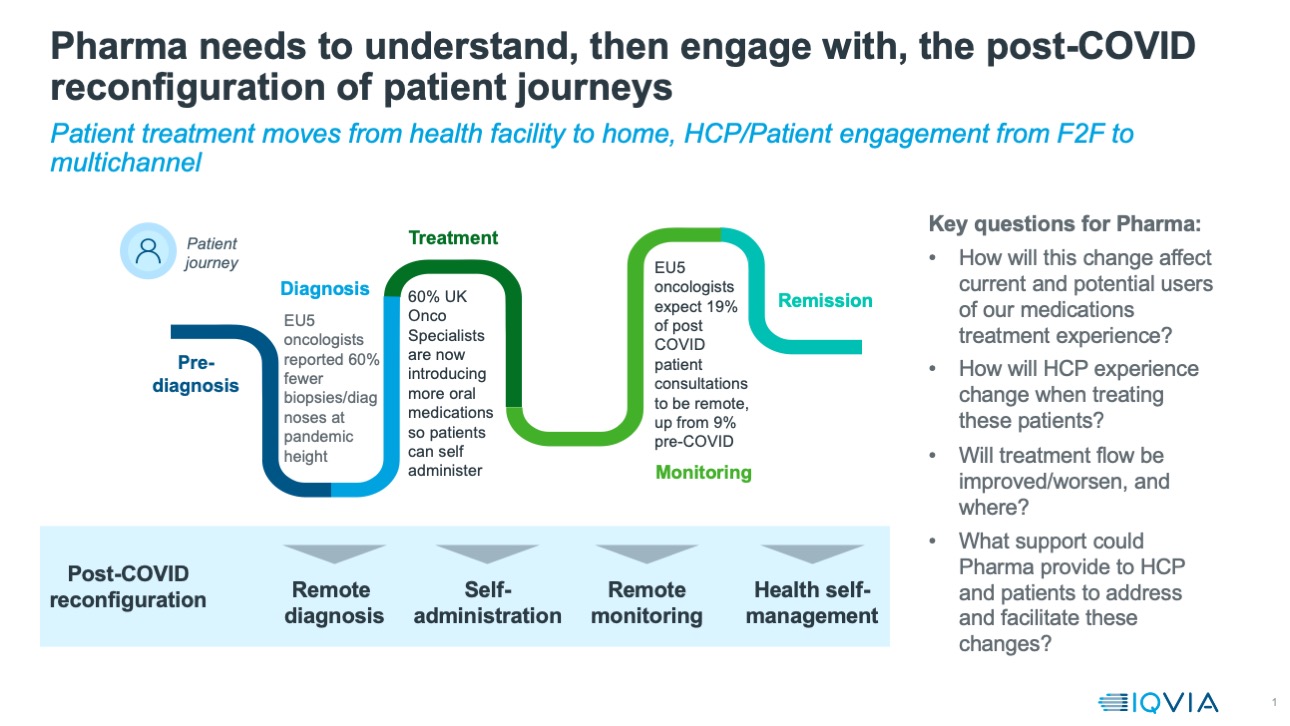

Across the world, lockdown brought cancellations of elective surgeries, replacement of face-to-face visits to healthcare professionals with remote consultations, and changes in healthcare provision, such as patients switching to oral or self-administered medication.

A study in the British Journal of Surgery estimated that, globally, 28 million procedures would be cancelled or postponed during the peak 12 weeks of COVID disruption. Prescription behaviour was also anticipated to take a hit.

Prior to the pandemic, while repeat prescriptions could be made remotely, new and switch prescriptions (the dynamic market) necessitated a face-to-face visit by the patient to the healthcare professional. As face-to-face visits collapsed, so did the opportunity for new and switch prescriptions. And indeed, IQVIA’s data shows that across all countries, and non-COVID related therapy classes, the dynamic market in prescriptions fell, sometimes dramatically. And the evidence is telling us that recovery will be slow.

Even now, with data to July for the US, IQVIA sees the dynamic market measure of ‘New to Brand’ depressed by between 6% and 40% compared to the equivalent period of 2019. This has the most impact on launching and recently launched products, as these see either all or a large share of their sales coming from new and switch prescriptions. If the dynamic part of the overall market is severely reduced in size, they will be the first products to be affected.

Reduction in patient visits is, of course, not just a problem for launch products. More broadly, if patients are not being diagnosed and treated at the rates they should be, there will be long term impacts on patient health and on healthcare systems.

The patient journey to effective diagnosis and treatment is being changed in many ways, as outlined in the image below. One of the most obvious near term impacts has been the rise in telemedicine and remote consultations. In the US, IQVIA data for the end of July show telehealth claims accounted for 11% of all visits – up from 1% in the pre-COVID baseline. In the UK, Health Secretary Matt Hancock has publicly expressed the ambition that all health consultations be conducted virtually wherever possible.

Cancer is a disease area where patient/doctor consultations were almost always conducted face-to-face prior to the pandemic - unsurprising in a condition needing multiple diagnostics and interventions, as well as the potential for hugely difficult and emotive discussions. However, IQVIA’s polling of oncologists and other cancer doctors across the five major European countries of Germany, France, Italy, Spain and the UK suggests that even for cancer, the proportion of visits that are remote will rise. Prior to COVID, the proportion of visits these doctors reported as remote was an average of 6% across these countries. During the pandemic crisis then, the proportion of remote visits reported by the same doctors rose to 56%. Looking forward, these doctors expect that after the pandemic is over, they will still undertake 20% of their patient interactions remotely.

Engaging with healthcare professionals: opportunities, channels and content

Finally, the reception that launch products may have from healthcare professionals is likely to be altered.

While IQVIA research from before the pandemic was already showing that the most commercially successful launches were also the launches with significantly higher volume shares of digital engagement, the fact is that the commercial strategy of prescription medicine launch still carries the presumption of significant face-to-face interaction. The pandemic severely reduced all contacts between pharma and HCPs for several months, and although volumes have recovered in some countries, the proportion of contacts that are face-to-face remains below 2019.

Significant changes in commercial models is one challenge; the receptiveness of doctors to launch products is another. As healthcare systems continue to be stretched, individual doctors will be time constrained. Their capacity to address, and enthusiasm for, new launches may be limited unless those new launches are revolutionary in their field.

Healthcare systems budgets and payers: market access and the focus on evidence

Outside their more obvious impact on healthcare systems, lockdowns have also affected the ability of regulators, health technology assessors and payers to play their usual roles in approving products, assessing their economic value and determining the funding available to support use of the product. While the impact across these groups has been variable - for example, the US has seen slightly more New Active Substance launches in 2020 than the historic average of the past five years - the impact on Health Technology Assessments (HTA) in particular has been very tangible.

Delays in HTA processes occurring as a result of the COVID-19 situation have resulted in a sharp fall in the volume of HTA output across EU markets, with drops of over 40% in HTA publications in March to May 2020 versus the previous five-year average. The single exception was Germany, where recent improvements in capacity and existing remote working meant output was close to historic norms.

Health Technology Assessors have evidently triaged their work to prioritise the areas of greatest unmet need – cancer treatment assessment saw a markedly smaller drop in assessment output than other, non-cancer areas.

For the rest of 2020 and into 2021, IQVIA expects there will be a tougher payer environment, with increasingly stringent evidence requirements for optimal market access, as a consequence of economic recession and stretched healthcare budgets. The need for a well-planned, systematic real-world evidence (RWE) strategy which delivers a high level of publications, was already demonstrated by IQVIA’s 2020 paper, Excellent Launches are winning the Evidence battle, where for three highly competitive therapy areas, we consistently found that the commercially excellent launches were also the launches with the highest productivity of RWE publication, before and after approval. The reasons for this are multifactorial, with improved market access for superior health economic outcomes one, but there is also a strong commercial reason.

In the pandemic and post-pandemic environment, the opportunities for HCP engagement are likely to be lower, and more often lower quality (in terms of time spent and level of interactivity) than prior to the pandemic. A strong stream of RWE publications gives companies a compelling reason to engage with HCPs more often, and for a more involved level of discussion. Thus, a coordinated, strategic investment in RWE becomes a tool to drive launch success via both improved market access and superior HCP engagement.

The new launch environment

With the imposition of widespread lockdowns, attention turned to whether companies with approved products would choose to go ahead with their launch during lockdown.

The ethical dilemma of whether it was better to press ahead with bringing the product to patients waiting for it, or wait until healthcare systems no longer had their time and energy consumed by COVID patients was a very real one. In the event, there were few deliberate delays to launch, but that did not mean that the launches which happened were anything like they were planned.

‘Soft launches’ are decidedly uncommon in the pharmaceutical industry, and with good reason. First, the patent clock is ticking for any innovative product, and a product that has just been approved may have already spent ten of its 20-year patent life in clinical development. Companies seek early return on their multiyear investment. Second, as IQVIA has shown, for pharmaceutical products the first six months of an innovative launch’s commercial life is disproportionately important in how most products do later on; 80% of launches do not improve on the trajectory, strong or weak, established in their first six months.

There are, of course, 20% of launches that are exceptions - the launches which started with average or worse than average launch trajectories and managed to change their fate and adopt a significantly improved trajectory. These will be the launches that companies with ‘pandemic launches’ should study, to understand the actions that improve on a weak start.

Pharmaceutical companies have been forced by pandemic circumstance into launches that have had little of the intense face-to-face support they would have seen pre-COVID, entering healthcare systems still focused on pandemic containment and addressing the treatment backlog, and with patient access diminished and patient journeys radically altered. The big question is whether these launches have lost ground, and if so, can they recover that lost ground in a period of ongoing uncertainty and with long term – and, in the case of remote pharma/HCP and patient/HCP engagements, possibly permanent – changes to the launch environment.

Companies which launched in the first half of 2020 should be considering special plans for ‘ongoing launch’ for these products in 2021 to build their full potential. These should include:

Understanding changes in the patient journey, and especially the healthcare system interactions which drive new and switch prescriptions, and identifying where services, information and support might help recover the dynamic market.

Understanding changes in HCP working practices and channel preferences, and building an engagement strategy which adapts to channel preference changes and provides HCP support in their changed environment. This may, in the longer term, prompt more significant changes in the emphasis of the commercial model. Whether it does or not, emphasis on an orchestrated approach to HCP engagement has never been more important.

Building an effective real-world evidence base, using an international platform to support and strengthen local country engagement. The association of superior RWE productivity, in publication terms, with commercial success was already established. In the pandemic launch environment, it will be needed more than ever to address more stringent payor requirements, and to build engagement with HCPs in a changed promotional environment.

We have noted the COVID-19 pandemic is not one crisis, but several. For innovative pharmaceutical companies, the three crises of the immediate pandemic, the post-pandemic healthcare system crisis and the economic crisis could be joined by a fourth: getting the return on their innovative launch and growth products that they expected and deserve. A realistic, detailed appraisal of the new healthcare environment with respect to launch, and effective, strategic investment in the right areas to drive future success are vital components of post pandemic launch excellence.

About the Author

Sarah Rickwood has 26 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has wide experience of international pharmaceutical industry issues, having worked for most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan and leading emerging markets, and is now vice president, European thought leadership at IQVIA, a team she has run for eight years.

Sarah Rickwood has 26 years’ experience as a consultant to the pharmaceutical industry, having worked in Accenture’s pharmaceutical strategy practice prior to joining IQVIA. She has wide experience of international pharmaceutical industry issues, having worked for most of the world’s leading pharmaceutical companies on issues in the US, Europe, Japan and leading emerging markets, and is now vice president, European thought leadership at IQVIA, a team she has run for eight years.